pay indiana state property taxes online

Chemist. If your Property is up for Tax Sale making payment online WILL NOT remove it from the sale.

Blog Us Tax Lien Association Types Of Taxes Us Tax Exit Strategy

This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card.

. Emergency Alerts and Public Notices System. Please direct all questions and form requests to the above agency. How Long Can You Go Without Paying Property Taxes In Indiana.

La Porte County Government accepts online payments for Traffic Tickets Probation Fees Property Taxes and more. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax accounts in one convenient. Only authorized banks can accept on-time payments.

The official website of Delaware County Indiana. The transaction fee is 25 of the total. 4TAX 4829 or 1888 You can pay your property tax by mail.

In addition eCheck payments are. Pay Property Taxes Online. Your total payment including the credit card online transaction fee will be calculated and displayed prior to the completion of your transaction.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. If you have an account or would like to create one or if you would like to pay with Google Pay PayPal or PayPalCredit Click Here. You need to come in the office and bring.

Animal Health Board of. Take the renters deduction. The County Treasurer is the property tax collector and custodian of all monies with responsibility for investing idle funds and maintaining an adequate cash flow.

The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax account s in one. Community. Call 855-423-9335 with questions.

Agriculture Indiana State Department of. Claim a gambling loss on my Indiana return. Property.

How Do I Pay My Indiana Property Taxes. Make sure you are paying for local payments Enter our location information Indiana Vanderburgh County Follow. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one.

Use First Name Last Name Example. A 250 150 minimum processing fee is charged for creditdebit card payments and a 395 fee is charged for Visa and MasterCard Debit Tax Programs. ONLINE BANKING or PHONE Pay by creditdebit card or e-check at wwwbartholomewingov paperless billing.

In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad valorem property tax levied for state or local purposes Indiana Code 6-6-65. Have more time to file my taxes and I think I will owe the Department. After selling to a corporation buyers in Indiana get a year after the sale to pay redemption expenses and repossess their.

Please contact the Indiana Department of Revenue at 317 232-1497. During pay year 2022 the United States Department of Treasury has allocated 16700000000 to assist Indiana homeowners who have experienced financial hardships related to COVID-19. PAY TAXES ONLINE at wwwpaygovus NOTE.

File Homestead and Mortgage Deductions Online. Building A 2nd Floor 2293 N. Online Payments - Visa MasterCard American Express or Discover credit cards debit cards.

Pay my tax bill in installments. Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources. 20 N 3rd Street.

Pay Your Property Taxes. A convenience fee will be assessed 6. FirstNameJohn and LastName Doe OR.

Find Indiana tax forms. Pay Property Tax Online. You can pay your property tax over the phone by calling 317327.

Main Street Crown Point IN 46307 Phone. Know when I will receive my tax refund.

About The Local Tax Finance Dashboard Gateway

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Median Household Income And Taxes State Tax Levels In The United States Wikipedia Ricevimenti Valutazione

How To Read Your Property Tax Bill Community Development

State Of Ohio Refund Cycle Chart 2014 29 Louisiana State Tax Forms Picture Louisiana State Tax Forms State Tax Chart

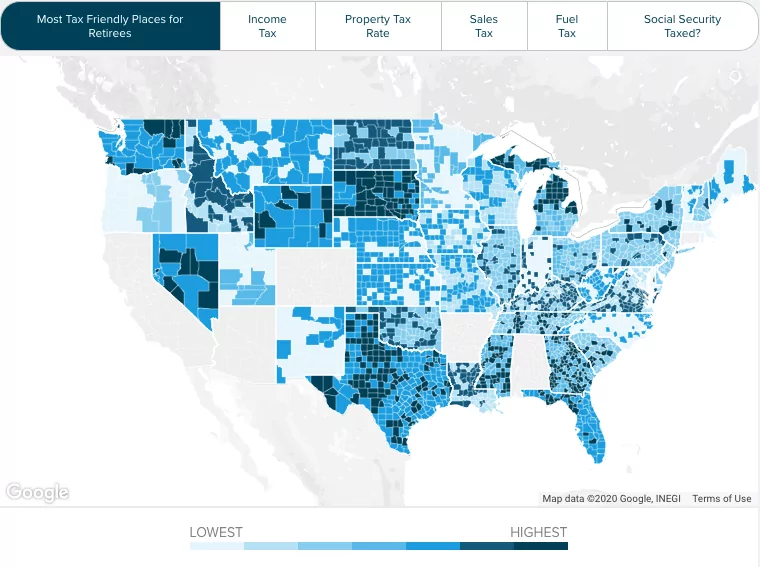

Indiana Retirement Tax Friendliness Smartasset

Indiana Sales Tax Small Business Guide Truic

States With Highest And Lowest Sales Tax Rates

About The Local Tax Finance Dashboard Gateway

Property Taxes By State Embrace Higher Property Taxes

Treasurer Johnson County Indiana

Where S My State Refund Track Your Refund In Every State Taxact Blog

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Great Addition Tax Attorney Tax Refund Tax Lawyer