owner draw quickbooks s-corp

From here choose Make Deposits. Solved S Corp Officer Compensation How To Enter Owner Eq Say you open a.

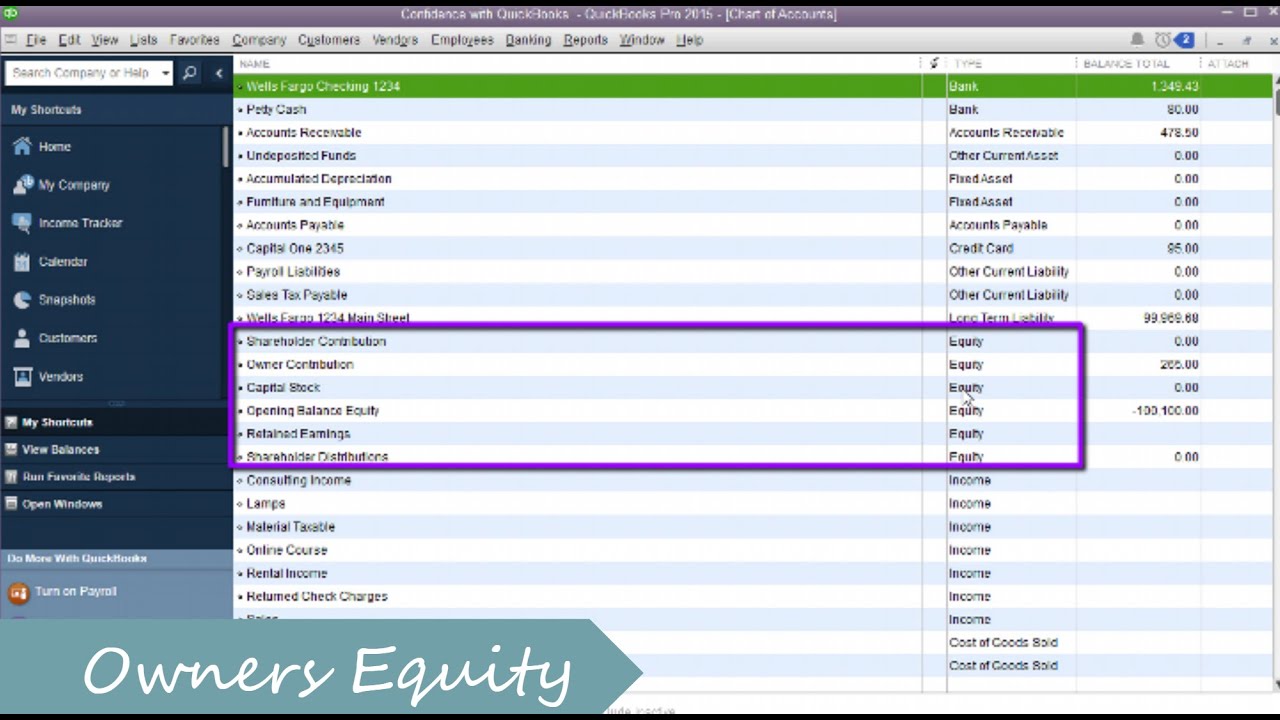

I Need Help With Owners Equity Entry

S-corp contribution and distribution help.

. Here are some steps. Owner Draw Quickbooks S-Corp. Click on the Banking menu option.

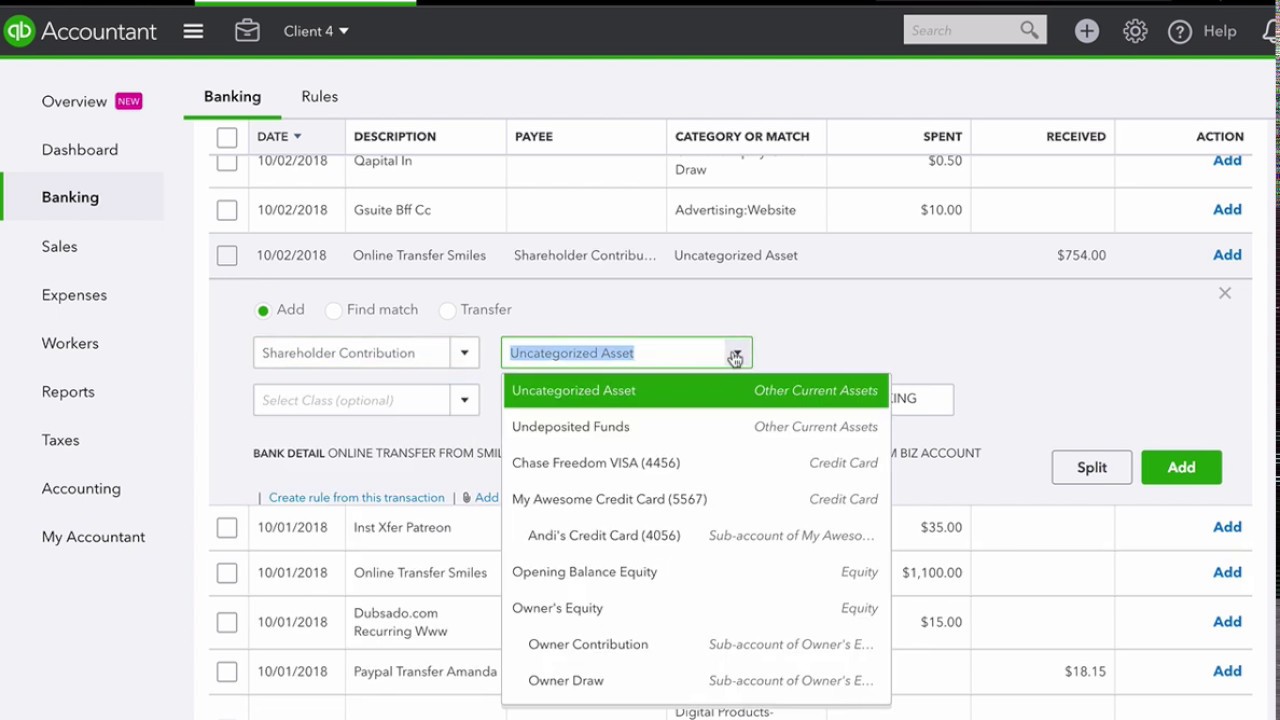

Instead shareholders can take both a salary and a dividend distribution. Set up and process an owners draw account. Click the New button.

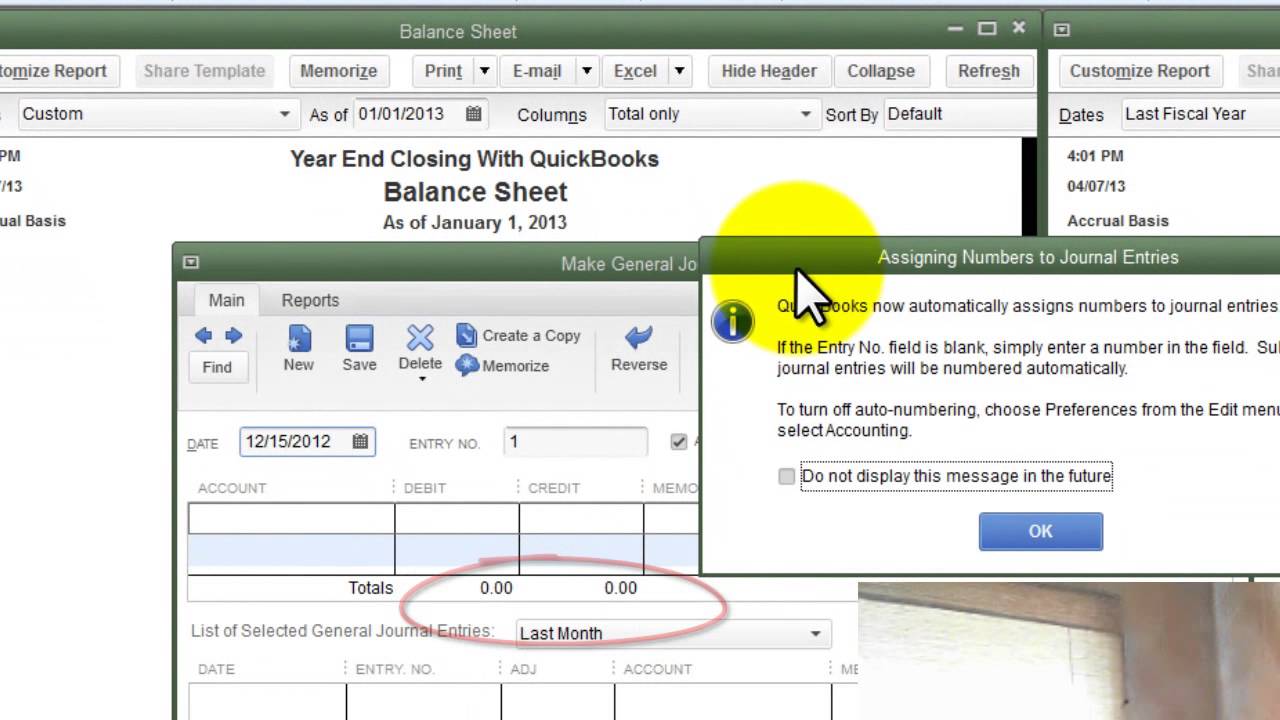

In QuickBooks Desktop software. Open the QuickBooks Online application and click on the Gear sign. Learn about Recording an Owners Draw in Intuit QuickBooks Online with the complete ad-free training course here.

I named mine Businesses - MY BUSINESS NAME with my actual business name of course. Ad Transform And Streamline Your Operations With NetSuite. Navigate to Accounting Menu to get to the chart of accounts page.

Owners draw in a C corp. Kintone gives you the flexibility to seamlessly integrate with other systems. Ad Streamline workflows surrounding QuickBooks with Kintone.

Owners draws can be scheduled at regular intervals or taken only. Visit the Lists option from the main menu. Owners draws can be scheduled at regular intervals or taken only when needed.

Kintone gives you the flexibility to seamlessly integrate with other systems. But I cant find. I worked as a consultant for several years in NY.

In this video we demonstrate how to set up equity accounts for a sole proprietorship in Quickbooks. An owners draw also known as a draw is when the business owner takes money out of the business for personal use. I really appreciate help for my s-corp QuickBooks.

An owners draw gives you more flexibility than a salary because you can pay yourself practically whenever youd like. New Jersey United States. Up to 15 cash back Im the owner and only emlopyee of S-corporation in NJ.

C corp owners typically do not take draws. Heres the work around Im using. Before you can record an owners draw youll first need to set one up in your Quickbooks account.

This occurs if the S corp acquired a previous C corp that had earnings and profits or the S corp was a previous C corp and converted to S corp and also had EP. We also show how to record both contributions of capita. Add Only What You Need At A Fraction Of the Cost Of Other ERPs.

An owners draw account is an equity account in which QuickBooks Desktop tracks withdrawals of the companys assets. To delete the expense transaction simply open it click the More menu then select Delete. Pros of an owners draw Owners draws are flexible.

You may find it on the left side of the page. I lost my - Answered by a verified Employment. 1 I paid around 80k from my own account as startup expensesI put it as owner.

Ive seen that for a Corp when giving to it it should be marked as Shareholder Loan. An owners draw can help you pay yourself without committing to a traditional 40-hours-a-week paycheck or yearly salary. Then choose the option.

Now hit on the Chart of. A members draw similarly called an owners draw or partners draw records the amount taken out of a company by one of its owners. At the upper side of the page you need to.

Add Only What You Need At A Fraction Of the Cost Of Other ERPs. QuickBooks records the draw in an. From an accounting standpoint owners draws are shown in the equity portion of the balance sheet as a reduction to the owners capital account.

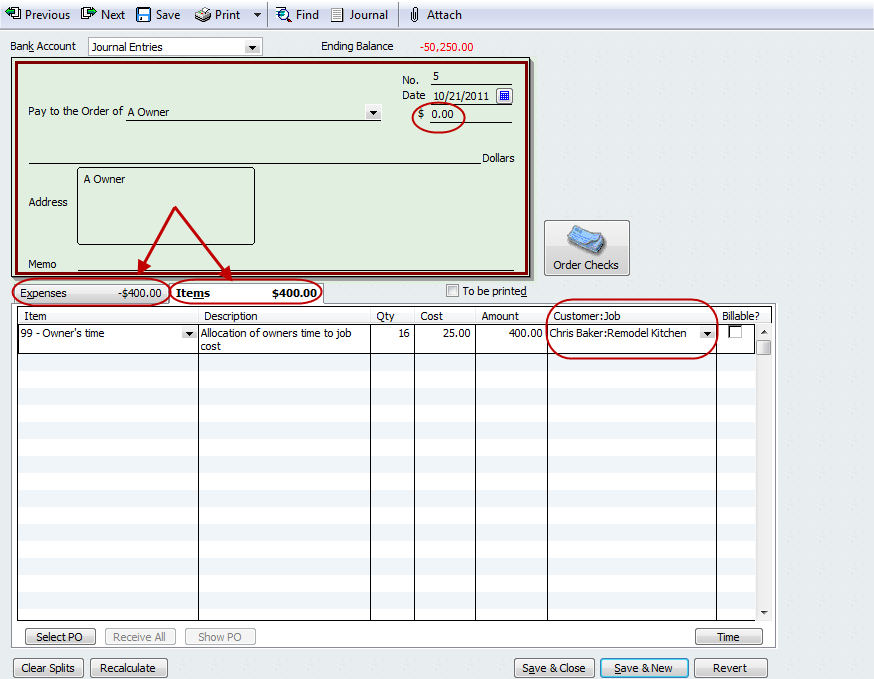

To Write A Check From An Owners Draw Account the steps are as follows. To record an owner contribution in Quickbooks launch the Quickbooks program and click the Banking tab at the top of the home screen. A C corp dividend is taxable to.

Instead you make a withdrawal from your owners. Here are few steps given to set up the owners draw in QuickBooks Online. Ad Streamline workflows surrounding QuickBooks with Kintone.

Next process the draw through a check. Ad One Hub for Tailored End to End Solutions Customized for Your Industry. Business owners might use a draw for compensation versus paying themselves a salary.

Setting Up an Owners Draw Before you can record an owners draw youll first need to set one. Create a personal Other Asset account. Setting Up an Owners Draw.

However when taking money out for repayment Ive seen it say label as Owners Draw. Whether we say quickbooks owners draw or owners draw. Ad Transform And Streamline Your Operations With NetSuite.

Open the chart of accounts and choose Add Add a new Equity account and title it Owners Draws If there is more than one owner make separate draw accounts for each. This article describes how to Setup and Pay Owners Draw in QuickBooks Online Desktop. Ad One Hub for Tailored End to End Solutions Customized for Your Industry.

Owner S Draw Vs Payroll Salary Paying Yourself As An Owner With Hector Garcia Quickbooks Payroll Youtube

Setup And Pay Owner S Draw In Quickbooks Online Desktop

Year End Closing With Quickbooks Youtube

6 Mots Essentiels Pour Comprendre Les Finances De Votre Entreprise Comprendre Entrepr Bookkeeping Business Small Business Bookkeeping Small Business Finance

How To Structure The Equity Section Of Your Balance Sheet In Quickbooks Online Youtube

How Can I Pay Owner Distributions Electronically

Solved Owner Has Been Incorrectly Taking Owners Draw Inst

How To Categorize Shareholder Distributions And Contributions In Qbo Youtube

How To Pay Expenses W Owner Funds In Quickbooks Online Youtube

Quickbooks Owner Draws Contributions Youtube

Quickbooks Tip Applying Owner S Time For Job Costing Long For Success Llc

I Need Help With Owners Equity Entry

Learn How To Record Owner Investment In Quickbooks Easily

Solved S Corp Officer Compensation How To Enter Owner Eq

Apply S Corp Medical At Year End For Corporate Officers Insightfulaccountant Com

How To Setup And Use Owners Equity In Quickbooks Pro Youtube

How To Set Up A Chart Of Accounts In Quickbooks Qbalance Com